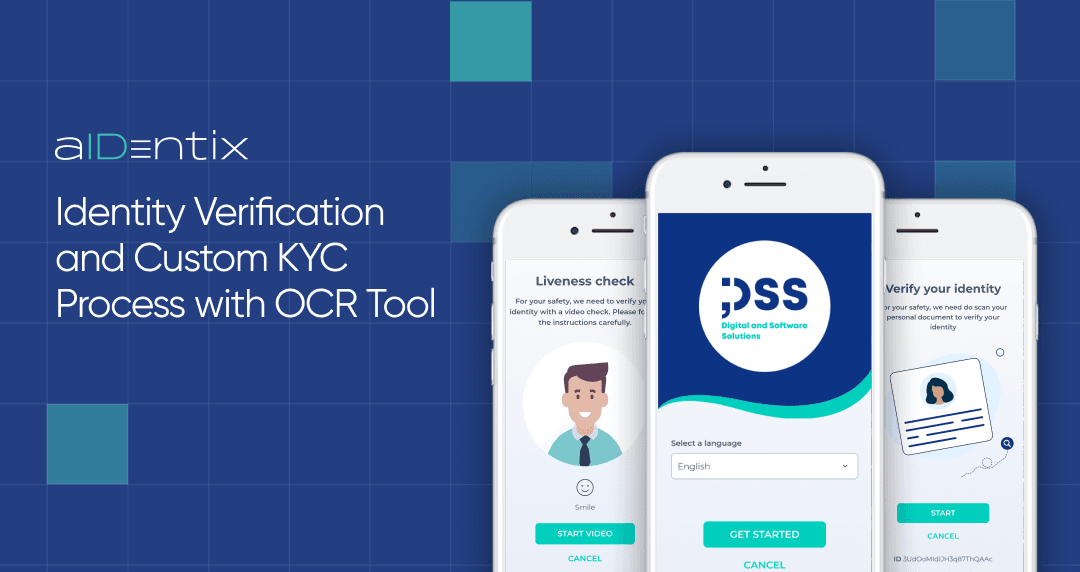

In the ever-evolving digital landscape, businesses face mounting challenges to verify identities, comply with severe regulatory requirements, and prevent fraud. At Digital and Software Solutions - DSS, we understand these complexities and are excited to announce the launch of our first in-house product, aIDentix. This OCR (Optical Character Recognition) technology transforms how businesses approach identity verification and KYC (Know Your Customer) processes. By automating these processes, companies can reduce the risk of fraud and ensure compliance with regulations, all while saving hours of manual work.

A New Chapter for DSS

Our journey has always been about helping organisations optimise their workflows and digitise operations. With a global presence and a track record of successful partnerships with top-tier global banking, energy, and education companies, DSS has established itself as a trusted name in consulting and software development. The launch of aIDentix marks a significant milestone as we expand our portfolio to include our own software solutions, offering clients advanced tools to enhance efficiency and security.

aIDentix: The New Way of Identity Verification

aIDentix leverages the latest advancements in artificial intelligence to provide a comprehensive, accurate, and efficient identity verification solution. Here are the key features that transform aIDentix into a desirable solution for financial institutions, fintech companies, insurance businesses, and SMEs.

Optical Character Recognition (OCR)

aIDentix's Optical Character Recognition (OCR) technology enables the remote capture of ID cards or documents from all sides, ensuring comprehensive data acquisition. Users can initiate the process by scanning physical documents or uploading digital files in various formats such as JPEG, PNG, or PDF. This flexibility allows aIDentix to handle a wide range of document types and sources, making the initial step seamless and convenient. Intelligent preprocessing ensures that the documents are in optimal condition for accurate data extraction, even if the original files are imperfect. Once the data is extracted, it undergoes a validation process to ensure accuracy and completeness. The validated data is then exported into a structured format, ready for integration with your existing systems.

ID Verification

The AI-powered algorithms of aIDentix verify IDs, passports, and other personal documents with exceptional precision. This automated system speeds up the onboarding process and detects and prevents fraud by identifying record inconsistencies and anomalies. It also can unveil fake IDs created using AI, ensuring that photos are not artificially generated. Verification is expedited by instantly rejecting blurry, expired, or unsupported IDs. Additionally, it analyses user behaviour and data patterns to identify potential fraud attempts. Our team of experts is available to conduct manual checks for complex cases or additional security. To further increase trust and security, there is an option for a live video interview with the user.

KYC & Custom Questionnaires

With aIDentix, businesses can create tailored KYC questionnaires that align with specific regulatory requirements and meet unique business needs. The system allows for the design of custom questionnaires with different question types, such as multiple choice, text fields, and document uploads. These questionnaires can seamlessly integrate into your onboarding process, ensuring a smooth user experience. aIDentix efficiently collects all necessary information from applicants, leveraging AI-powered risk scoring to identify potential risk factors based on the collected data. All collected information is easily accessible and analysed within a centralised system, facilitating compliance and enhancing the overall effectiveness of the KYC process.

Liveness Verification

aIDentix's liveness verification, which uses human gestures and facial expressions, is a powerful tool in confirming the document holder's identity. This feature provides a high level of security by ensuring the person is physically present during verification. It effectively prevents spoofing attempts, detects AI-generated, deepfake videos and confirms genuine user interactions, thereby significantly boosting the reliability of the identity verification process.

Database Verification

We conduct thorough checks on public databases, population registers, and PEPS or AML lists as an added measure to prevent fraudulent activities. By cross-referencing information against reliable sources, the system ensures that all data is accurate and trustworthy.

Address Verification

aIDentix offers flexible options for verifying user addresses, either through additional document uploads or geolocation methods. This feature mitigates the risk of fraudulent activity by ensuring that users reside at the stated location.

The Benefits of Choosing aIDentix

The primary advantage of aIDentix lies in its user-friendly design, easy integration, and rapid deployment. Businesses can seamlessly integrate aIDentix as a "plug-and-play" solution into their operations without extensive training or lengthy setup times.

Another standout benefit is aIDentix's adaptability. The solution offers multiple integration options, including Web SDK, Mobile SDK, REST API, QR codes, and custom integrations with third-party applications. This flexibility ensures that aIDentix can seamlessly integrate into existing systems, regardless of the technological landscape.

aIDentix is a cost-effective solution, typically involving a monthly fee with features that can be customised based on business needs. Custom packages are also available, allowing companies to select the expected verifications required. This ensures that organisations receive excellent value for their investment while benefiting from a comprehensive and reliable identity verification system.

Embrace the Future with aIDentix

At DSS, our mission is to empower businesses with innovative solutions that drive efficiency and security. aIDentix represents our strive for frictionless identity verification, offering a seamless, robust, and customisable solution that meets the diverse needs of our clients. By automating the KYC process and ensuring compliance with local and global regulations, we not only enhance your overall operational efficiency but also save you valuable time and resources, providing relief in your daily operations.

Explore how aIDentix can transform your identity verification and KYC processes, and contact us today to book a demo!