How DSS Leverages AI and OCR to Streamline KYC Compliance in Banking

Manual KYC (Know Your Customer) checks in banks are time-consuming and resource-draining. DSS Bulgaria revolutionizes this process with AI-powered Optical Character Recognition (OCR) technology that automates identity verification, cuts operational costs, and speeds up compliance. Leading banks such as United Bulgarian Bank and UniCredit Bulbank are already using it.

Why Banks Struggle with KYC

KYC is essential for preventing fraud and money laundering, but it often comes with significant challenges for financial institutions:

- Manual Document Checks: Slow and labor-intensive.

- Human Error: High risk of mistakes during manual data entry.

- Customer Frustration: Lengthy verification processes.

- Operational Costs: High expenses from manual labor and inefficient processes.

The Solution: AI-Driven OCR for KYC

DSS Bulgaria has developed an advanced AI-based OCR system specifically designed for banks and fintech companies. It automatically extracts and verifies data from:

- ID Cards

- Passports

- Utility Bills

- Tax Documents

- Selfies and Biometric Confirmations

The system instantly matches extracted data with internal databases and third-party verification tools, all in real time.

Benefits of DSS KYC Automation

- AI-powered OCR: Instantly extracts text from images and PDFs.в

- Biometric Matching: Verifies facial features against ID document photos.

- Instant Checks: Complete KYC verification in seconds instead of days.

- Dashboard & Audit Trail: Provides full auditability for regulatory compliance.

- Multilingual Support: Handles documents in various languages.

- API-Ready: Easily integrates with your current banking systems.

After integrating DSS's KYC tool, the following results were achieved:

“DSS’s OCR solution reduced our average KYC verification time by 64%.”

- 2x Faster Onboarding: Boosted the speed of customer onboarding.

- 35% Reduction in Compliance Processing Costs: Lowered the operational costs of compliance.

- Zero Manual Data Entry Errors: Achieved flawless accuracy after just three months.

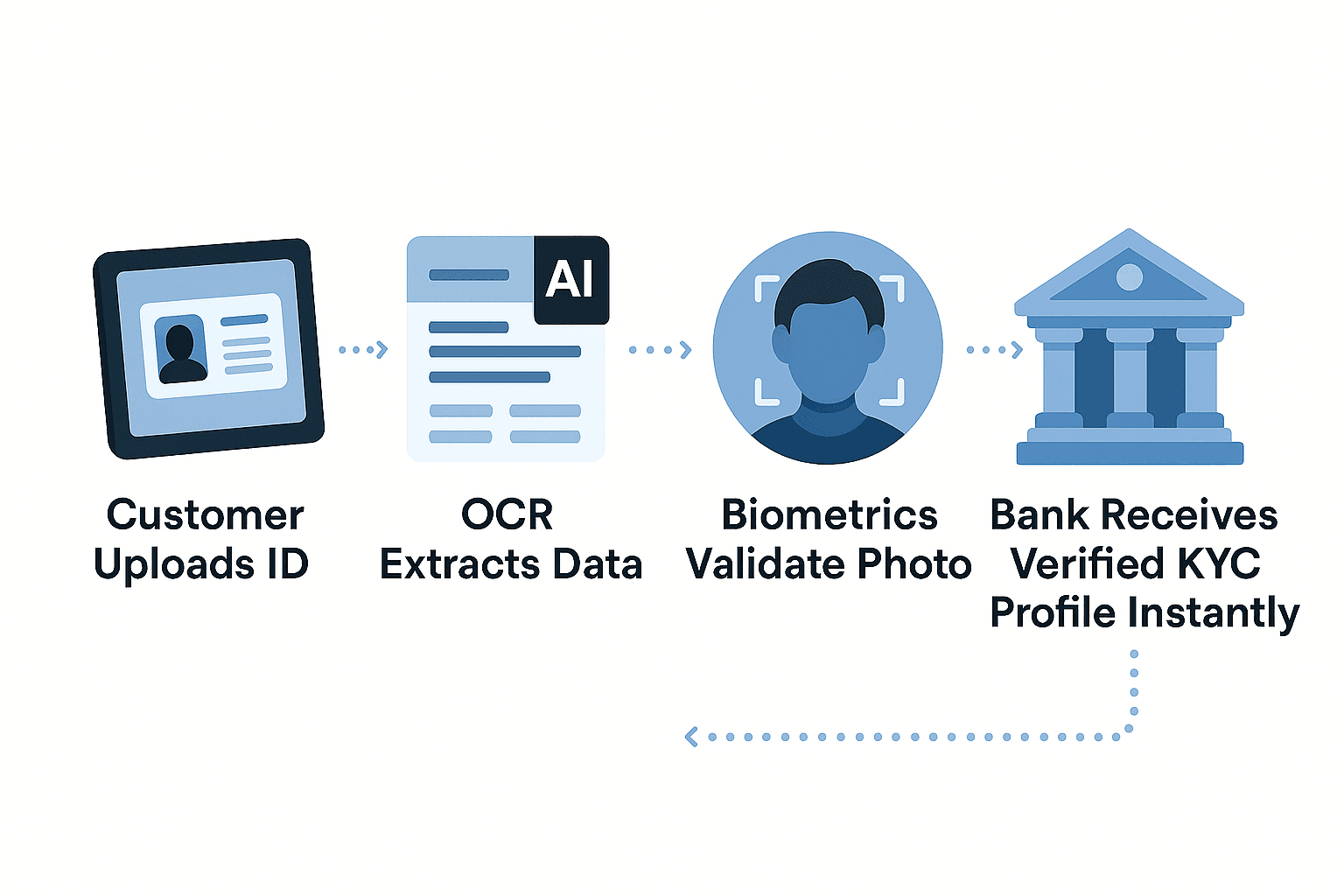

How It Works: A Simple Breakdown

- Customer uploads ID: User submits an ID document.

- OCR Extracts Data: The system scans and extracts relevant information from the document.

- Biometric Validation: A selfie or biometric data is matched with the ID photo.

- Real-Time Cross-Checks: Data is verified against internal and third-party databases.

- Instant KYC Profile: The bank receives a fully verified KYC profile in seconds.

Why DSS?

DSS is one of Bulgaria's premier AI implementation partners. With over 50 enterprise clients, including UniCredit Bulbank and United Bulgarian Bank, DSS specializes in driving digital transformation with AI, ServiceNow, and KYC compliance solutions.

Your Questions Answered

Question: What sets DSS apart from generic OCR providers?

Answer: DSS combines advanced OCR with AI logic and biometric verification, all specifically optimized for regulatory compliance in the banking sector.

Question: Is this GDPR-compliant?

Answer: Yes. DSS’s system adheres to EU data protection regulations, and we ensure that sensitive user data is only stored with explicit consent.

Question: Can this integrate with our current onboarding app?

Answer: Absolutely. Our APIs are developer-friendly and designed to seamlessly integrate with existing banking systems.

Want to See It in Action?

Request a free demo of DSS’s AI-powered KYC solution.

- Contact us at [email protected] or visit www.dss.bg to learn more.