As digitalisation accelerates across the financial sector, so do the risks that come with it. Cyberattacks, software failures, supply chain issues, and operational disruptions are no longer theoretical threats — they’re real and present dangers. Recognizing this, the European Union has introduced a groundbreaking regulatory framework: the Digital Operational Resilience Act (DORA).

This regulation reshapes how financial institutions — from major banks to innovative fintechs — manage, monitor, and maintain digital resilience. Its enforcement, which begins in full in 2025, brings new standards for operational continuity, incident management, third-party oversight, and more.

But meeting DORA’s expectations isn’t easy — it requires the right digital infrastructure. This is where ServiceNow plays a critical role.

What Is DORA and Why Should Financial Institutions Care?

DORA was officially adopted by the EU in January 2023 and applies to a broad range of entities in the financial ecosystem, including:

- Credit institutions (banks)

- Investment firms

- Insurance and reinsurance companies

- Crypto-asset service providers

- Central counterparties and trade repositories

- ICT third-party service providers that support financial services

The regulation aims to harmonise digital operational resilience requirements across Europe, ensuring financial entities can prevent, detect, respond to, and recover from ICT-related incidents.

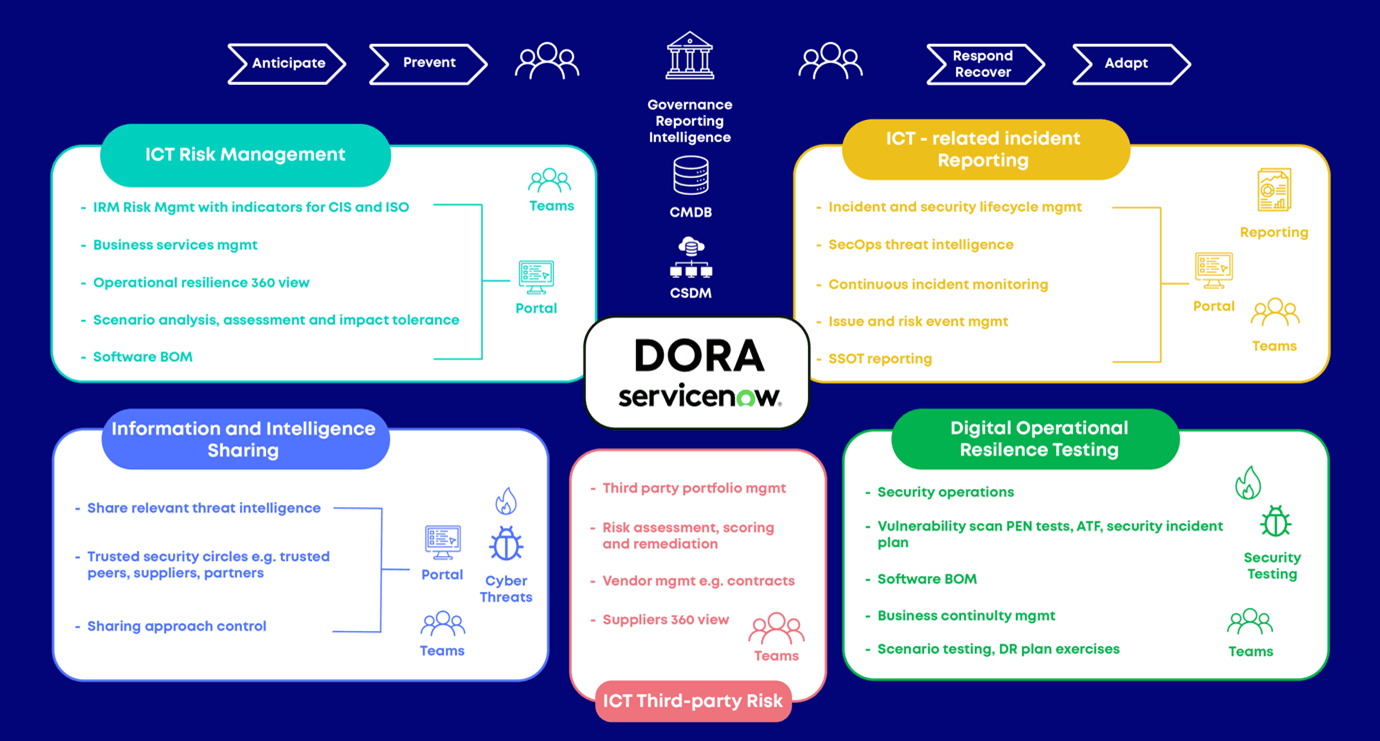

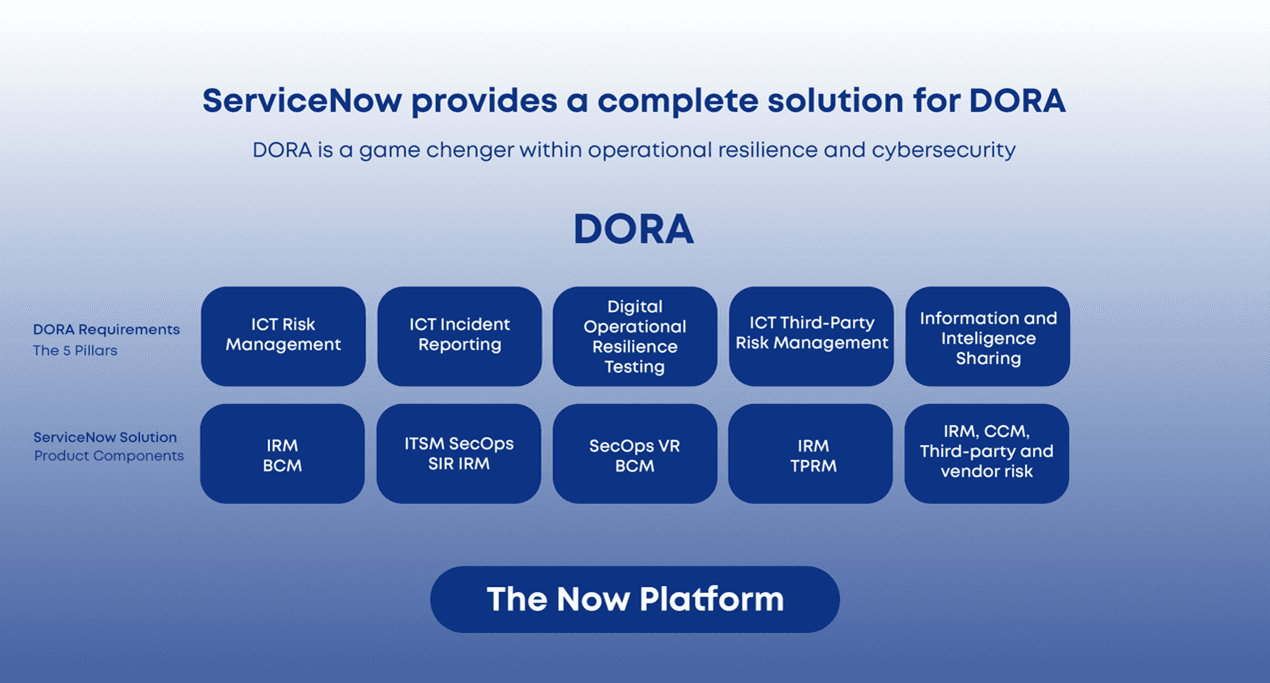

DORA’s five key pillars:

- ICT Risk Management – Establish a framework for identifying, classifying, and mitigating technology risks.

- Incident Reporting – Detect and report ICT-related incidents in a timely and structured manner.

- Digital Operational Resilience Testing – Regularly test systems and processes to verify their resilience.

- Third-Party Risk Management – Monitor and control risks related to external ICT service providers.

- Information Sharing – Encourage safe, anonymized information sharing between financial institutions to improve collective cyber resilience.

DORA mandates rigorous documentation, continuous monitoring, and a strategic approach to operational risk. For many organizations, these requirements can only be met by integrating advanced, automated, and intelligent platforms — such as ServiceNow.

Why Choose ServiceNow for DORA Compliance?

ServiceNow is a leading platform for digital transformation and service management. It excels in unifying disparate processes and systems into one connected digital workflow, making it uniquely equipped to support DORA-related initiatives.

Let’s explore how ServiceNow addresses each pillar of DORA with precision and efficiency:

ICT Risk Management: Automate Governance and Proactive Risk Handling

Under DORA, financial institutions must maintain a robust risk management framework that covers the full lifecycle of ICT systems — from design and development to deployment and decommissioning.

ServiceNow’s Governance, Risk, and Compliance (GRC) and Integrated Risk Management (IRM) modules provide:

- Risk identification and classification workflows

- Real-time monitoring of controls and compliance posture

- Custom risk scoring and treatment plans

- Automated policy management and evidence collection

With dashboards, heatmaps, and tailored alerts, ServiceNow empowers teams to move from reactive to proactive risk management. It also supports integrations with threat intelligence platforms, allowing organizations to contextualize and prioritize risks more effectively.

Learn how implementing GRC in ServiceNow can help reduce audit and compliance costs in this insightful article by DSS: How GRC Implementation in ServiceNow Can Reduce Audit and Compliance Costs.

Incident Reporting: Stay Compliant and Transparent

DORA requires all significant ICT incidents to be reported to national authorities and stakeholders within a defined timeline. This includes detailed records of the event, root causes, response actions, and recovery outcomes.

ServiceNow’s Security Incident Response (SIR) and IT Service Management (ITSM) modules enable:

- Automated incident detection and escalation workflows

- Root cause analysis and post-incident reviews

- Structured data collection aligned with regulatory templates

- Dashboards to track SLAs and response effectiveness

Using AI and machine learning, ServiceNow can also predict potential outages and reduce mean time to resolution (MTTR). This makes it easier for compliance and IT teams to collaborate — ensuring incidents are handled quickly, correctly, and with the proper audit trail.

Streamlined ITSM Processes with ServiceNow Implementation: A Successful Case Study

Digital Operational Resilience Testing: Prepare Before You’re Hit

One of the most forward-thinking elements of DORA is the emphasis on regular, scenario-based testing of ICT resilience. Financial organizations are expected to simulate cyberattacks, network outages, data corruption, and more — and prove they can respond effectively.

ServiceNow supports resilience testing through:

- Business Continuity Management (BCM) – define and maintain continuity plans

- Disaster Recovery workflows – simulate IT disruptions and assess readiness

- Crisis Management modules – coordinate teams during high-stress events

- Customizable playbooks – execute and log responses in real time

With automated documentation and detailed testing reports, organizations can demonstrate compliance, identify process gaps, and strengthen their preparedness year over year.

Third-party Risk Management: Trust, But Verify

DORA imposes strict rules on the use of third-party ICT service providers, especially cloud infrastructure, software vendors, and managed security services. Organizations must monitor vendor performance, security posture, and contractual obligations continuously — not just during onboarding.

ServiceNow’s Vendor Risk Management (VRM) module centralizes:

- Vendor profiles and risk assessments

- Due diligence questionnaires

- Performance scoring and SLA monitoring

- Third-party incident tracking

Integrating VRM with IRM and GRC allows organizations to see vendor risk in the broader context of operational resilience. For instance, if a key cloud provider experiences downtime, ServiceNow will alert risk officers, update continuity plans, and notify impacted stakeholders automatically.

Audit Trails & Reporting: Transparent, Trustworthy, and Real-Time

One of the major compliance challenges for DORA is maintaining complete auditability. Regulators want to see evidence: when an incident occurred, who responded, what was done, and how effective it was.

ServiceNow excels in:

- End-to-end workflow logging

- Role-based access controls

- Custom dashboards for auditors and regulators

- Regulatory report generation (PDF, Excel, etc.)

By maintaining a single source of truth, ServiceNow eliminates the need for manual evidence collection and spreadsheet-based tracking — reducing human error and improving regulatory confidence.

Creating a Culture of Digital Resilience

DORA compliance is not a one-time task — it’s a long-term operational shift. It requires organizations to:

- Align IT, risk, security, and legal teams

- Establish continuous monitoring and response capabilities

- Rethink how they engage with third parties

- Stay agile as threats and regulations evolve

ServiceNow enables this cultural shift by breaking down silos, automating repetitive tasks, and providing decision-makers with actionable insights. It transforms resilience from a burden into a competitive advantage.

Moreover, by leveraging ServiceNow’s AI capabilities, organizations can predict risks before they occur, prioritize based on real-time context, and create feedback loops that continuously improve digital resilience processes.

Effective risk management often requires streamlined processes and tailored solutions. A great example of this in action is DSS’s work with a film studio, where they optimised ServiceNow to better support industry-specific needs: Streamlining ServiceNow for a Film Studio.

Ready to Get Started?

Whether you're just starting your DORA journey or need to fine-tune existing systems, DSS is here to help.

Contact us for a consultation → DSS

Final Thought

DORA is reshaping the way the financial sector thinks about digital operations. It places responsibility — and accountability — squarely on the shoulders of financial institutions. But with the right tools, meeting these expectations becomes not only manageable but also transformational.

ServiceNow offers a comprehensive, scalable, and integrated platform to meet DORA’s demands head-on. From ICT risk management and incident reporting to resilience testing and third-party oversight, it delivers the capabilities you need to thrive in a high-stakes digital environment.

Whether you're a multinational bank or a fast-growing fintech, investing in operational resilience today means safeguarding your future tomorrow.

Your Questions Answered

Question: What is the Digital Operational Resilience Act (DORA)?

Answer: DORA is an EU regulation adopted in 2023, taking full effect in 2025. It mandates financial institutions to strengthen their digital operational resilience by setting standards for ICT risk management, incident reporting, resilience testing, third-party oversight, and information sharing.

Question: Who does DORA apply to?

Answer: DORA applies to a wide range of financial entities including banks, investment firms, insurance providers, crypto-asset service providers, central counterparties, and third-party ICT service providers supporting the financial sector.

Question: What are the five key pillars of DORA?

Answer: The five core pillars of DORA are:

- ICT Risk Managemen

- Incident Reporting

- Digital Operational Resilience Testing

- Third-Party Risk Management

- Information Sharing

Question: Why is ServiceNow a strong solution for DORA compliance?

Answer: ServiceNow unifies risk, security, and operations into one platform. It automates key processes, ensures real-time monitoring, generates audit-ready reports, and supports all five DORA pillars with specific modules for GRC, IRM, SIR, BCM, and VRM.

Question: How does ServiceNow support ICT risk management under DORA?

Answer: Through its GRC and IRM modules, ServiceNow enables proactive risk identification, classification, treatment planning, real-time monitoring, and policy management — helping organizations shift from reactive to proactive risk strategies.

Question: What tools in ServiceNow help with DORA-compliant incident reporting?

Answer: ServiceNow’s Security Incident Response (SIR) and IT Service Management (ITSM) modules automate incident detection, escalation, and reporting while maintaining structured documentation and traceability for regulators.

Question: How does ServiceNow help with resilience testing?

Answer: ServiceNow’s Business Continuity Management (BCM), Disaster Recovery, and Crisis Management modules allow for scenario-based testing, continuity planning, response coordination, and automated documentation to support DORA’s testing requirements.

Question: Can ServiceNow monitor third-party ICT service providers for DORA compliance?

Answer: Yes. The Vendor Risk Management (VRM) module tracks vendor performance, risk scores, SLAs, and third-party incidents, ensuring continuous oversight and integration with broader risk frameworks.

Question: What are the audit and reporting capabilities in ServiceNow for DORA?

Answer: ServiceNow provides full workflow logging, role-based access, dashboards for auditors, and exportable reports — eliminating manual processes and enhancing audit readiness.

Question: How can DSS help with DORA compliance through ServiceNow?

Answer: DSS offers expert consultation, platform implementation, module customization, and ongoing support to help financial institutions meet DORA’s technical requirements and transform resilience into a competitive edge.